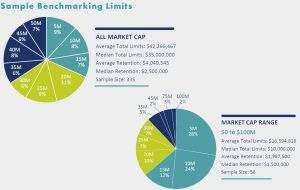

This year’s inaugural survey, conducted in collaboration with Nasdaq, saw over 330 companies provide key policy information regarding their D&O insurance. The result was an independent look at purchasing and spending trends in the current D&O marketplace.

“Directors & Officers Liability pricing for public companies has been increasing exponentially over the past several years. It is more important than ever to have access to truly objective data about what your peers are purchasing and what they are paying, and our collaboration with Nasdaq to collect this data is a big step in that direction.”

The report provides data about total average and median limits purchased, as well as average and median retention amounts, broken out by market caps ranging from $0-$50B:

Premium By Market Cap

In addition to limits and retention benchmarking, the report also provides a look at the premiums being paid for $5M of coverage across market caps and industries:

The report further breaks down limits and purchasing data by industry, as well as highlights various sectors, such as Healthcare and Technology, that are seeing some of the highest premium and retention amounts in the country. The report also goes in-depth about the disparities between recent IPO’s and more tenured public companies, in both rate and retention.

In addition, the report includes data about:

- Changes in rate since last year

- Changes in corporate buying habits and policy structure

- Top carriers that are most typically found in primary coverage positions

- Feedback from insurance carriers about tougher industry classes and rate changes