Commercial Risk Insurance

BUILD, PROTECT & THRIVE WITH BRP RISK MANAGEMENT

You’ve built a strong business—protect its future with solid risk management. Our commercial risk specialists at Baldwin Risk Partners provide holistic insurance solutions to improve your business’s bottom line. By leveraging our comprehensive RiskMap process, we help clients find solutions that fit their budgets and needs.

Never underestimate the importance of a contingency plan in the event that something goes wrong with your business. This could be a fire in your warehouse, vandalism of your storefront, stolen customer credit information, and anything in between. Companies need to be ready for the unexpected. Solid commercial risk management is critical to protecting what you’ve worked so hard to create. Minimize liability, manage risk, and preserve your assets with BRP.

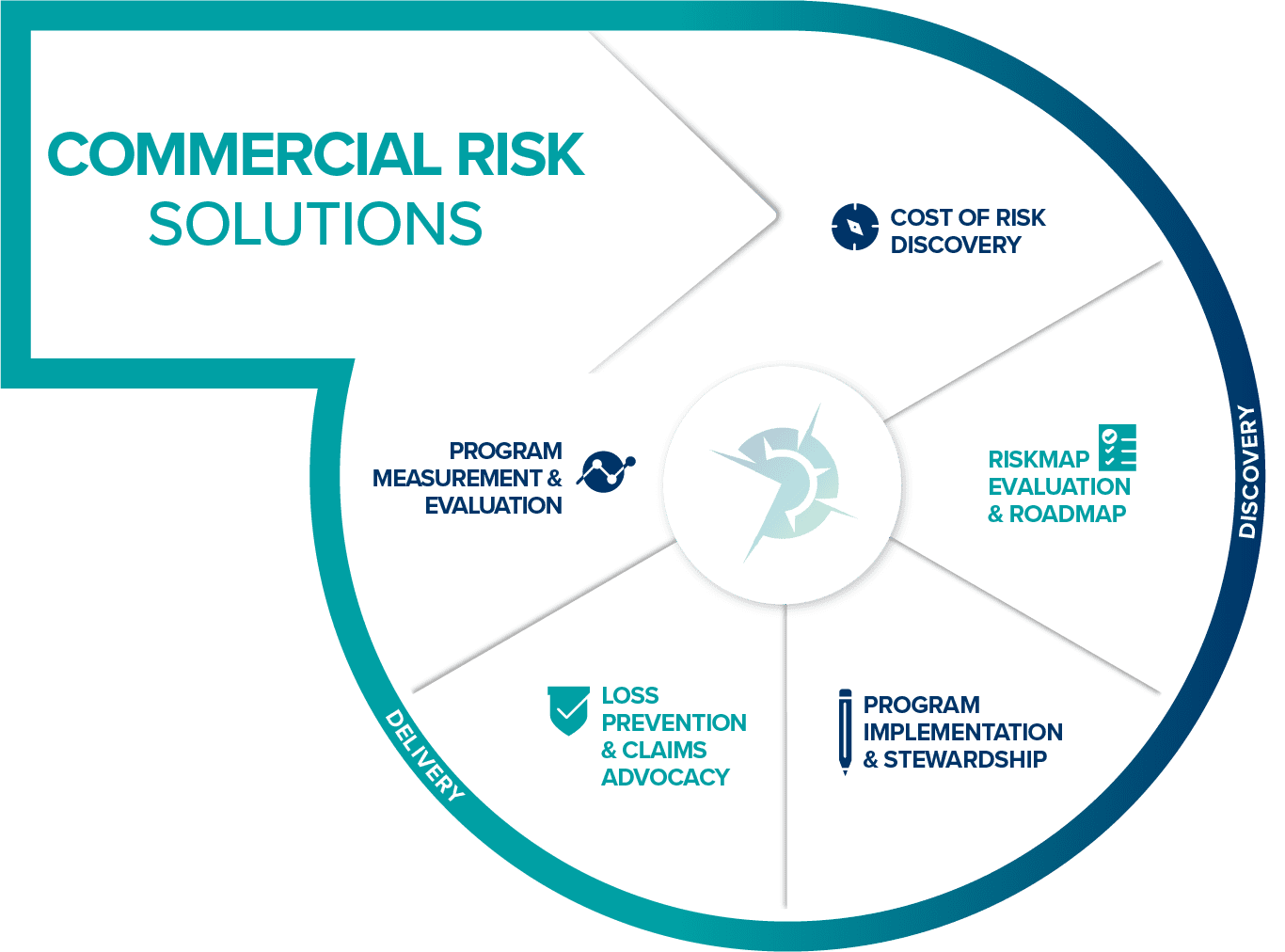

Our full-circle approach helps us stand out, so you can too.

The rocky post-COVID-19 climate is not the only factor that stands in the way of your business’s success. Cyberattacks, supply chain disruptions, regulatory evolutions, and increasing pressures from clients and consumers all play a role in the tumultuous commercial risk management landscape.

Our commercial risk experts help bolster businesses’ resiliency in a variety of areas. The most common include:

Property & Casualty: This typically includes both liability and property coverage. As it relates to commercial risk, an example of when this coverage comes into play is if you’re doing repairs on a leaky roof in your restaurant and a customer slip and falls from a puddle created by the leaky roof. Property and casualty coverage can cover medical expenses, pain and suffering, loss of income, as well as cover legal fees if you are sued by the customer.

Cybersecurity: Both brick-and-mortar and online businesses need to be aware of increasing cyber threats. Any business that stores data on a digital device is susceptible to a cyberattack. Securing a solid cyber policy can be the difference between keeping your business afloat and being forced to close your doors in the event of a cyberattack or breach. Cyber insurance can help cover the costs of recovering and restoring lost data, loss of funds, as well as legal and public relations fees.

Crisis management: Regardless of industry, all businesses are vulnerable to unexpected events that may negatively impact their reputation. Crisis management is a component of errors & omissions (E&O) insurance that helps cover costs needed to restore an organization’s reputation after a triggering event. For example, a medical group that experienced a breach of patients’ personal information would implement crisis management coverage to reimburse expenses required to re-establish confidence in the medical group’s security measures.

Strategic & Enterprise Risk Management: Strategic risk management (SRM) evaluates uncertainties, exposures, and opportunities for growth within an organization that impacts the implementation of new and existing strategies. Enterprise risk management (ERM) takes a holistic look at your organization’s risks and how they correlate in one comprehensive risk portfolio. Both risk management strategies are vital to understanding obstacles standing in the way or threatening your business’s success and how to overcome them.

Discovery

cost of risk discovery

risk management

loss prevention & claims advocacy

Delivery

custom program design

risk map implementation

core solutions & expertise

BRP knows commercial risk management. Take a look at our expertly polished offerings to get started with solutions that best suit your business’s needs.

Employee Benefits

Learn More

Cyber Risk Management

Learn More

Directors & Officers Liability

Learn More

Retirement & Wealth

Learn More

Private Risk & Family Office

Learn More

Captive

Learn More

For your business, your employees, and your clients

Our experts at Baldwin Risk Partners have the tools and experience to carry your business through the entire risk life cycle. Our industry expertise paired with our carrier-grade analytics tools give us the competitive edge our clients trust in providing them with quality insurance and risk management solutions. Stay resilient in these uncertain times and prepare for what lies ahead—we’ll help keep you on course for smooth sailing.