Compliance Alert by: The Baldwin Regulatory Compliance Collaborative (BRCC)

The COVID-19 National Health Emergency (NHE) and Public Health Emergency (PHE) remain scheduled to end on May 11, 2023, followed by the winding down of the COVID-19 outbreak period, set to end on July 10 (60 days after the end of the NHE).

Employer Action Items

- Review the Agency Guidance. Plan sponsors and employers should review the latest guidance provided in the FAQs carefully.

- Memorialize Temporary and Permanent Modifications. Plan sponsors should, where necessary, draft and adopt appropriate plan amendments to the terms of their plans adequately memorializing the scope and duration of any temporary or permanent modifications to the benefits, rights, and features of their employer sponsored plans.

- Develop a Participant Education Plan. To the extent plan or coverage modifications are required as a consequence of the ending of the PHE/NHE, develop a participant education plan to apprise plan participants and beneficiaries of their rights and obligations;

- Communicate the Education Plan. Notify participants and beneficiaries of the following:

- Modifications. Summary of any significant post-pandemic modifications affecting any rights or features of the employer’s plans;

- Limitations. Description of any limitations on benefits accruing in concert with the ending of the PHE/NHE periods;

- Effectiveness. Date ranges and the end dates for any special periods or features; and,

- Communications. Plan administration resources, including contact information for questions.

- Prepare and Adopt SMMs if Necessary. Consider whether any plan amendments require the preparation of a summary of material modifications (SMM) and disseminate to participants.

- Confirm Accuracy of Written Plan Documents and other Participant Communications. Assure plan documents and SPDs memorialize accurate and timely plan provisions, as in effect during the pandemic periods, as well as in the post-pandemic environment.

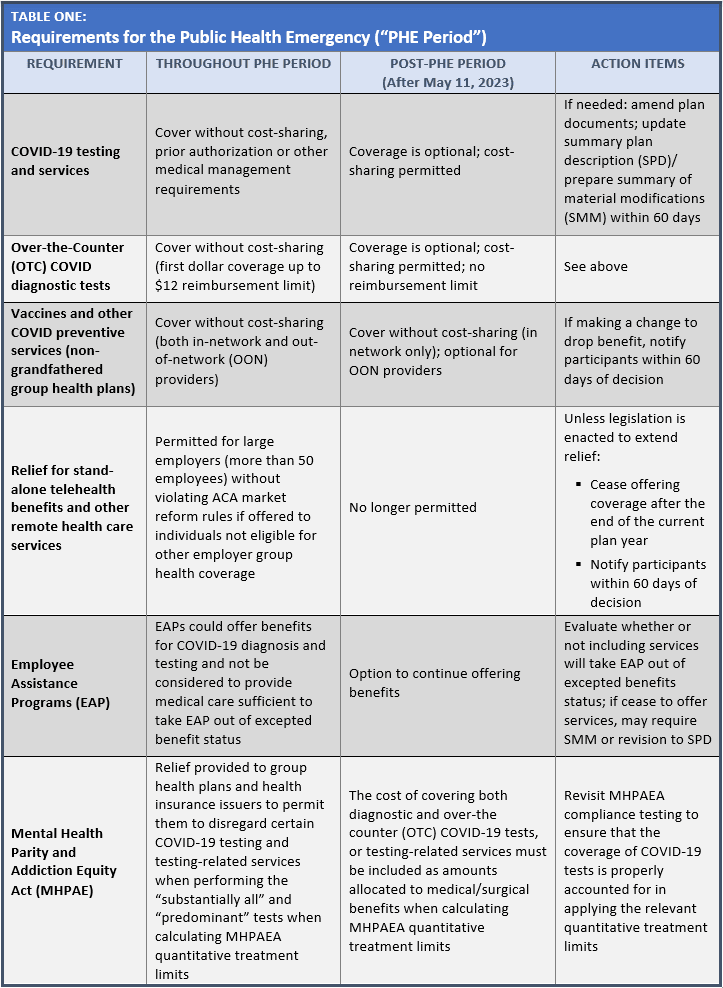

Impact to Group Health Plans

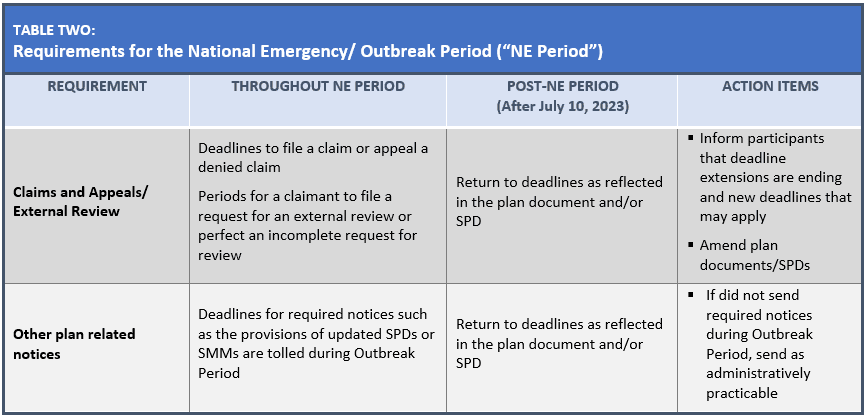

When the NHE and PHE periods end, health plans will no longer be required to cover COVID-19 diagnostic tests and related services without cost sharing. Health plans will still be required to cover recommended preventive services, including COVID-19 immunizations, without cost sharing, but this coverage requirement will be limited to in-network providers. In addition, once the COVID-19 outbreak period under the NHE ends, health plans can go back to their nonextended deadlines for purposes of HIPAA special enrollment, COBRA continuation coverage, claims and appeals procedures, and certain plan related notices.

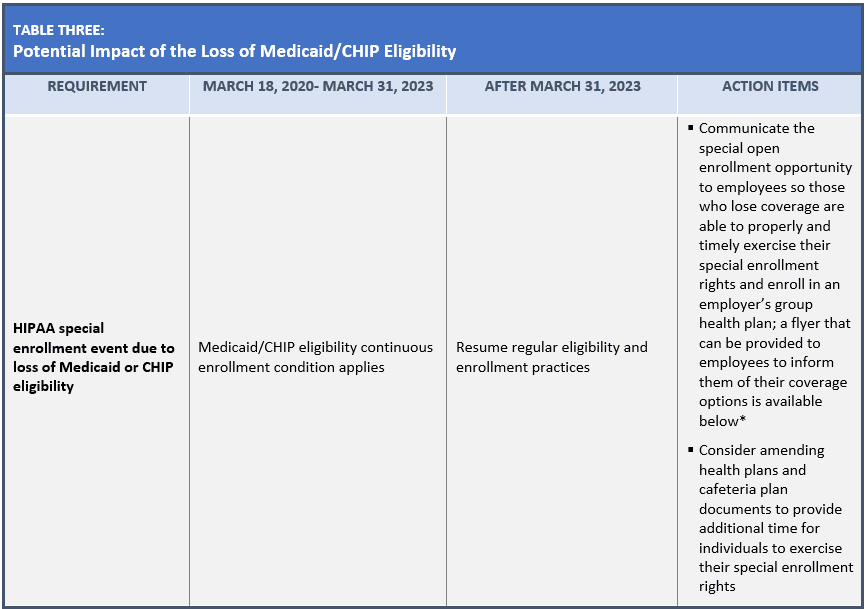

In addition, since the declaration of the PHE, most state Medicaid agencies generally have not terminated the enrollment of any Medicaid beneficiary who was enrolled on or after March 18, 2020, through March 31, 2023 (referred to as the continuous enrollment condition). As state Medicaid and Children’s Health Insurance Program (CHIP) agencies have resumed regular eligibility and enrollment practices after March 31, 2023, many individuals may now no longer be eligible for Medicaid or CHIP coverage and will therefore need to transition to other coverage, such as coverage through the Marketplace or through an employer-sponsored group health plan, resulting in a HIPAA special enrollment event to enroll in their employer’s health plan (or individual coverage).

Recent Guidance

On March 29, 2023, the Departments of Labor (DOL), Health and Human Services and the Treasury (Departments) issued a series of Frequently Asked Questions (FAQs) to clarify how the COVID-19 coverage and payment requirements in place during the pandemic will change once the PHE and NHE end. Specifically, the FAQs cover the following:

- COVID-19 diagnostic testing, including how to determine the date an item or service was rendered to an individual for purposes of COVID-19 testing coverage requirements;

- The rapid coverage of preventive services and COVID vaccines, and when plans and issuers must notify participants and enrollees if they change the terms of their coverage for the diagnosis or treatment of COVID-19 after the end of the PHE;

- How the ending of the extension of certain timeframes for employee benefit plans will work, with specific examples of their application, after the end of the outbreak period (anticipated to be July 10, 2023);

- Special enrollment in group health plan and group or individual health insurance coverage after loss of eligibility for Medicaid or CHIP coverage, or after becoming eligible for premium assistance under Medicaid or CHIP; and

- Benefits for COVID-19 testing and treatment and health savings accounts (HSAs)/high deductible health plans (HDHPs)

In addition, a related blog article posted by the Employee Benefits Security Administration/ DOL, is available here, as well as a Medicaid-CHIP SEP Options Flyer, that employers may use to communicate to its employees regarding options for individuals who lose their Medicaid or CHIP coverage as a result of the continuous enrollment condition ending.

Specifically, in contemplation of the end of the PHE and NHE, and to address the impact of the potential loss of Medicaid and CHIP eligibility, employers should consider certain action items as reflected in the following three tables: